by James Stefanile, ABR, GRI, SRES, QSC, gCertified, REALTOR/Salesperson, Berkshire Hathaway Home Services New Jersey Properties, Montclair Office

Recently I attended the Fall Housing Workshop hosted by Jeffrey Otteau of the Otteau Group, Inc. Mr. Otteau is generally recognized as one of the foremost authorities on New Jersey real estate. His seminars are always packed with facts which support his conclusions. Looking back on his prior predictions, he is invariably correct.

Jeffrey Otteau

Mr. Otteau mingled some macro-economics with this housing market status report and predictions. The recent economic trends are pertinent to the shifting housing market.

To start, the overall US economy is doing well with GDP growth above 4% and higher than predicted. Unemployment is at the lowest level since 1969. 2018 was the 8th consecutive year the economy gained more than 2 million jobs.

Significant, according to Mr. Otteau, is that the economy experienced an upward spike in early 2018 as a result of deregulation and tax cuts on businesses. This, as we will see shortly, has a direct bearing on the housing market.

These economic benefits are now allowing New Jersey to catch up. We’re doing better since the nation is doing better even though the state has been slow to the party. 2018 was the best year for job growth and creation since the recession ended with household income also rising by 4% as opposed to 1% in previous years. As a result New Jersey’s household income is now the 3rd highest in the nation. Our job engine has been currently driven by healthcare which has replaced tech as New Jersey’s strongest commercial sector. New Jersey unemployment is at 4.2% as opposed to 3.7% nationally.

The following slides are used with permission.

This map shows income and unemployment by county and you can see the northeastern part of the state is in the best shape with the exception of the unemployment gash running from Passaic county down through urban Essex and Union Counties. You’ll also notice that Essex and Union Counties are noted as distinct suburban and urban counties with different income and unemployment stats.

Through the 3rd quarter of 2018 the nation matched the number of transactions and their dollar value with 2005 which was the last year of the housing boom. It’s important to note that these healthy numbers were achieved without the help of sub-prime mortgage lending which was the leading cause of the boom years until 2006.

I’m sure everyone has heard the housing market is changing. The numbers, as you’ll see shortly support this. Mr. Otteau describes this as a housing market in transition with the advantage between buyers and sellers beginning to balance out. Sellers are no longer in control. Buyers may not have to “drive til you qualify” out of the eastern part of the state in order to find affordable housing and pragmatic sellers. Also, a declining market is not seasonal but, rather, a combination of rising home prices and higher interest rates which outpace income increases. This gap may give some buyers pause and will kick some buyers out of the market altogether. It is but one factor in the changing market. As homes linger longer for sale, prices may level off . The primary markets (towns) in New Jersey will be affected less (or not at all) and may continue to be competitive. These towns are mostly the “transit villages” with easy public transportation access to New York City.

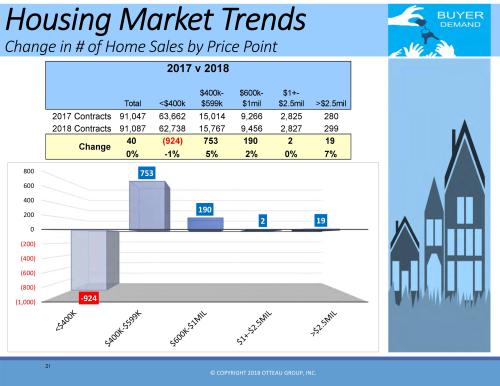

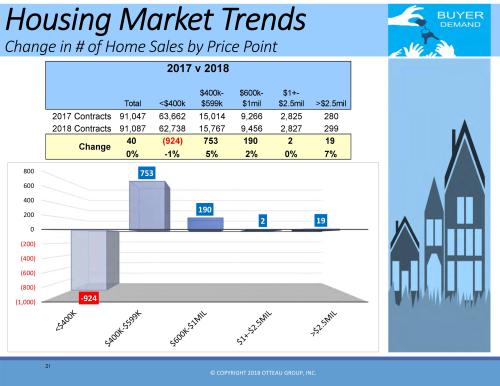

Here we see the comparison between 2017 and 2018 in number of units sold by price point. Notice the anemic growth year over year with the lowest price point actually decreasing slightly in number of units. The overall year to year numbers are flat.

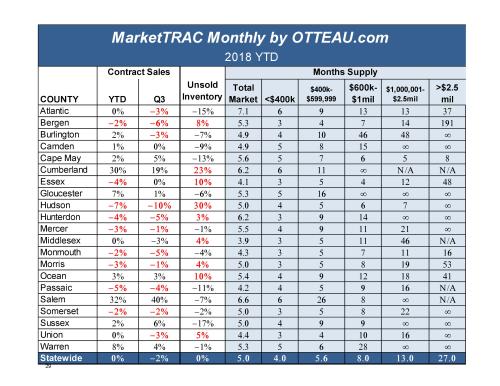

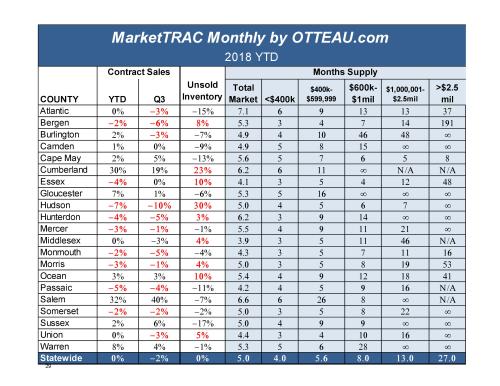

Digging a little deeper county by county shows a lot of slippage in number of contracts for housing sales. It also shows the months supply of housing for sale per county overall and per price point. It’s no surpise that the higher up the price point the greater the months of housing supply for sale. The statewide numbers at the bottom of the chart show flat yearly progress vs. the past overall.

Speaking of exceptions, here are the leading markets statewide with the lowest months supply of homes for sale. The weakest markets are towns that specialize in luxury housing or towns in the southernmost parts of the state.

Here’s 2 indicators in one. The bar graph shows the year over year home prices and the line graph shows them in relation to each other, rising and falling. The striking stats are the comparisons between 2017 and the estimates for 2018. Home prices, statewide, will rise very modestly. Again, primary markets may perform better than the statewide averages.

Nationally, home prices have rebounded 116% of the pre-recession prices. New Jersey state-wide prices have only recovered 92% of their pre-recession value – therefore, under-performing the national average by 24%. One reason is the migration of business out of the state due to the cost of doing business here.

Regarding interest rates, it’s no secret they have risen in the past year. The Federal Reserve has the unenviable task of addressing the rise in economic activity vs. the worries of investors and the volatility of the stock market in determining the rise or fall of interest rates. Interest rates, after all, are a regulator of the economy. The Fed can put the brakes on a burgeoning economy by raising rates in order to keep the engine cool and prevent an inflationary spiral which decreases the value of the dollar and can lead to a recession. This rise in rates has been expected for some time and is because the economy is strong. After all, if inflation rears its ugly head as it has in the past, rates must rise so that the dollar paid back from loans will equal the value of money originally loaned.

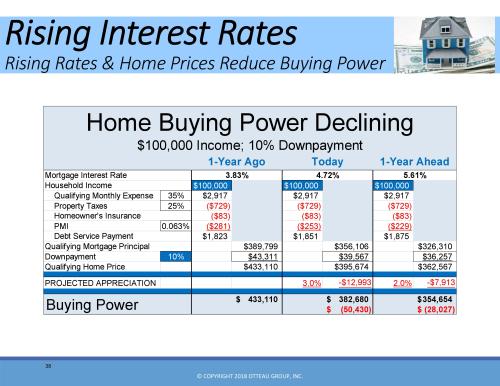

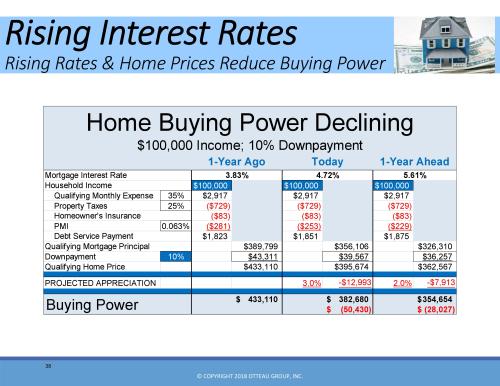

Obviously, mortgage interest rates are a key factor to the rise and fall of the housing market everywhere. As noted earlier, some buyers’ incomes may not keep pace with rising interest rates coupled with rising home prices. It’s important to remember that for every 1% rise in rates, a buyers purchasing power decreases by 9%. I’ve highlighted this fact since it’s a bedrock principle in housing. The chart below illustrates this relationship between rates and buying ability:

A household with a modest $100,000 annual income will only be able to afford a home price of $354,654 if rates rise to 5.61% as opposed to the $382,680 home they would buy at 4.72% or the $433,110 home they could have bought with a mortgage rate of 3.83%. The story is even more dramatic for a household with a $200,000 annual income who can only afford $973,656 as opposed to $1,223,568 as interest rate rise between the same 3.83% and 5.61%.

Accordingly, a buyer who waits now may be out of the market for the foreseeable future and a seller who waits to reduce his or her price will also lose. Waiting is never a good strategy if the circumstances in your life point you toward buying or selling. If your life encourages change action is better than not, regardless of market cycles.

Finally, here are the biggest winners and losers among New Jersey towns with regard to future price increases as expressed in percentages per year. You will notice the “transit villages” are among those with the biggest gains vs. the “luxury heavy” towns, among the biggest losers of value.

There’s a lot to take in and, just for fun, some conflicting forces clouding the picture. Mr. Otteau predicts the housing market still has room to grow and he’s confident we won’t go into a recessional spiral for another few years. In the meantime, my advice is to follow your needs – don’t wait for the market to catch up with you and, certainly, don’t let the perceived market work against fulfilling your needs.

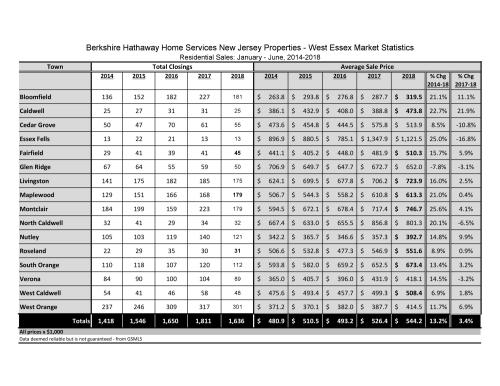

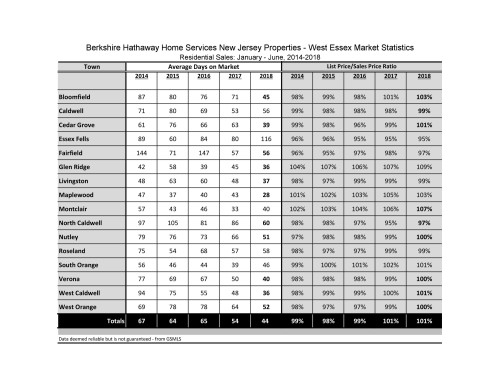

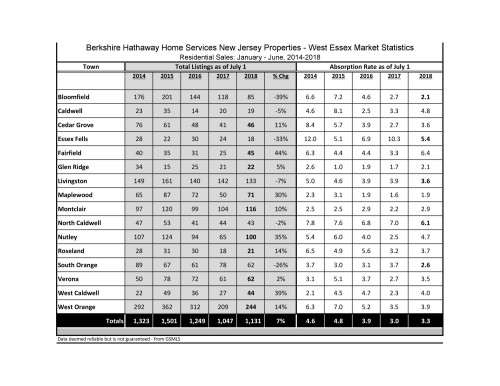

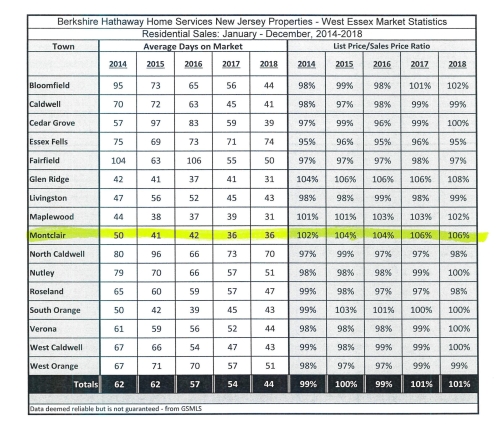

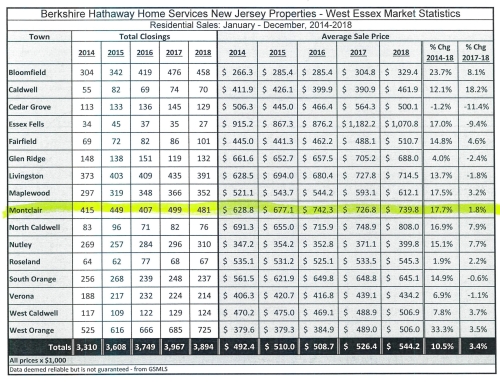

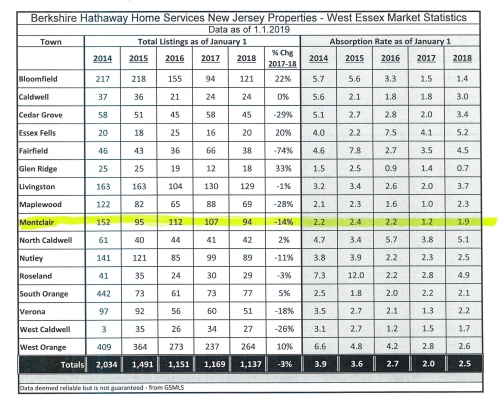

Finally, this table shows the total number of listings taken per year and the absorption rate per town. The absorption rate is the time it would take to sell what’s on the market expressed in months. Most towns have a lower absorption rate vs. 2014 (some only a little bit lower), but a couple have rates that have risen substantially. These are towns with a greater proportion of luxury properties. That segment has been losing steam for about a year. Overall, the rate has fallen almost by half.

Finally, this table shows the total number of listings taken per year and the absorption rate per town. The absorption rate is the time it would take to sell what’s on the market expressed in months. Most towns have a lower absorption rate vs. 2014 (some only a little bit lower), but a couple have rates that have risen substantially. These are towns with a greater proportion of luxury properties. That segment has been losing steam for about a year. Overall, the rate has fallen almost by half.